Product Overview

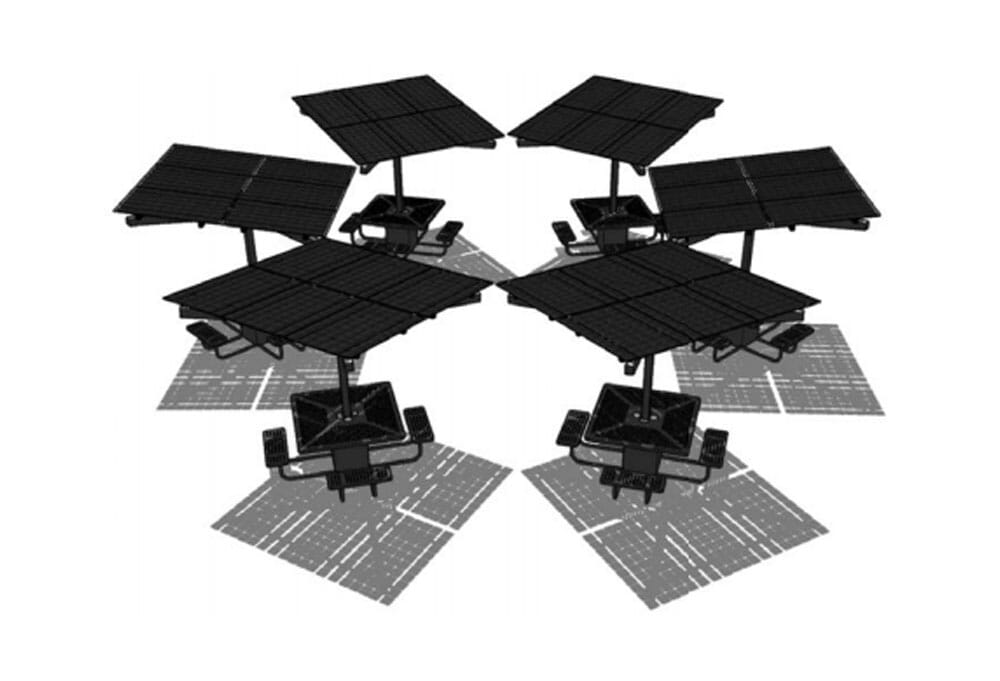

The SolarZone solar charging and shade table is the perfect solution for creating a comfortable and functional outdoor workspace or classroom. Ideal for outdoor spaces at universities, colleges, schools, corporate campuses, stadiums, cafes, restaurants, soccer fields, golf courses, or anywhere you need a seat in the shade and a place to get a charge!

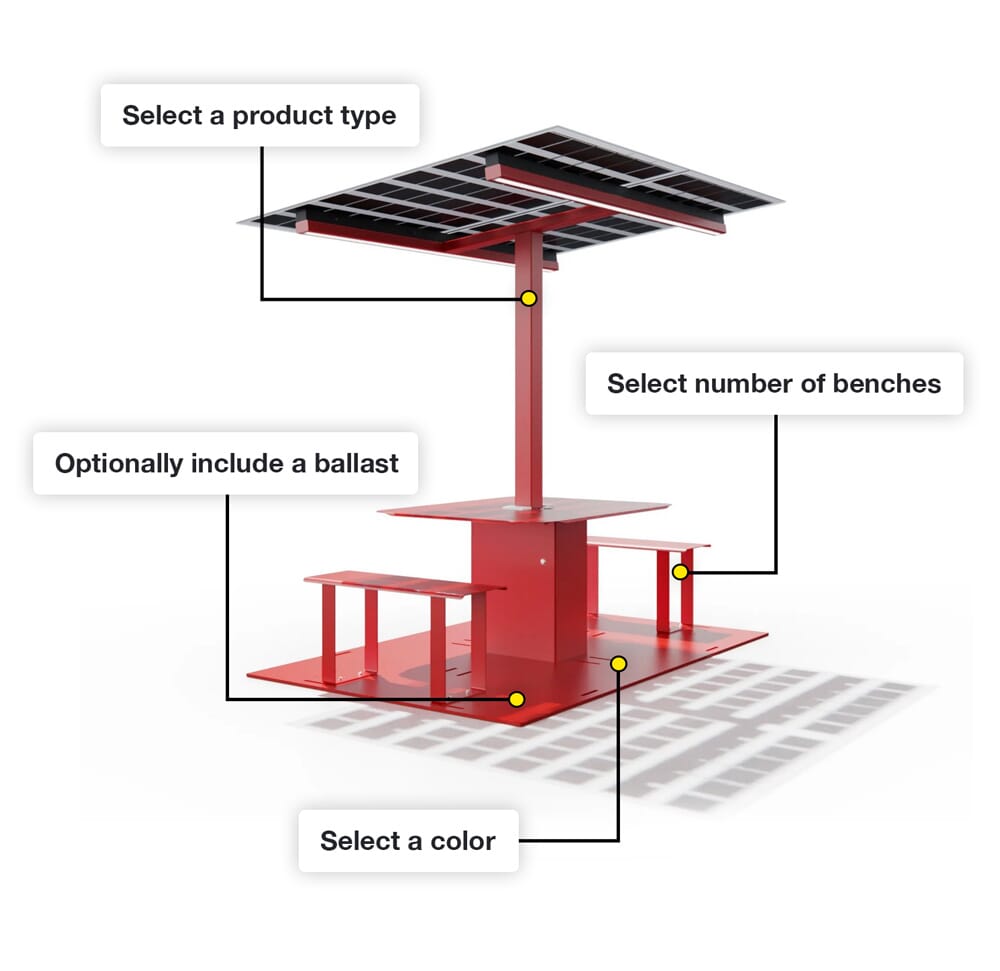

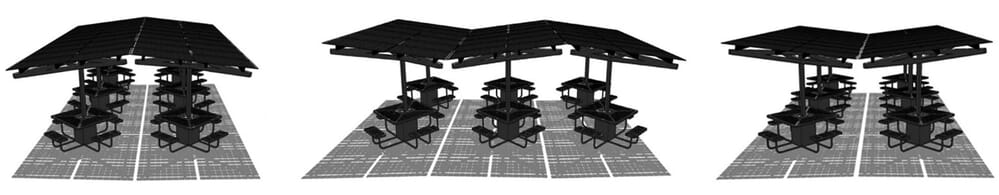

The SolarZone is available in two models Cafe and Team with several customizable options. Use the SolarZone Configurator to create your unique setup and request pricing for your configuration.

Key Features:

- The SolarZone can be installed anywhere and does not require foundations or underground electrical work.

- SolarZones feature Bluetooth programmable LED lighting and data monitoring.

- SolarZones are available with optional bench seats and are ADA Compliant.

- Our Vision Module System is super durable, looks great and provides plenty of shade and clean solar power to keep the batteries fully charged day and night.